modified business tax nevada due date

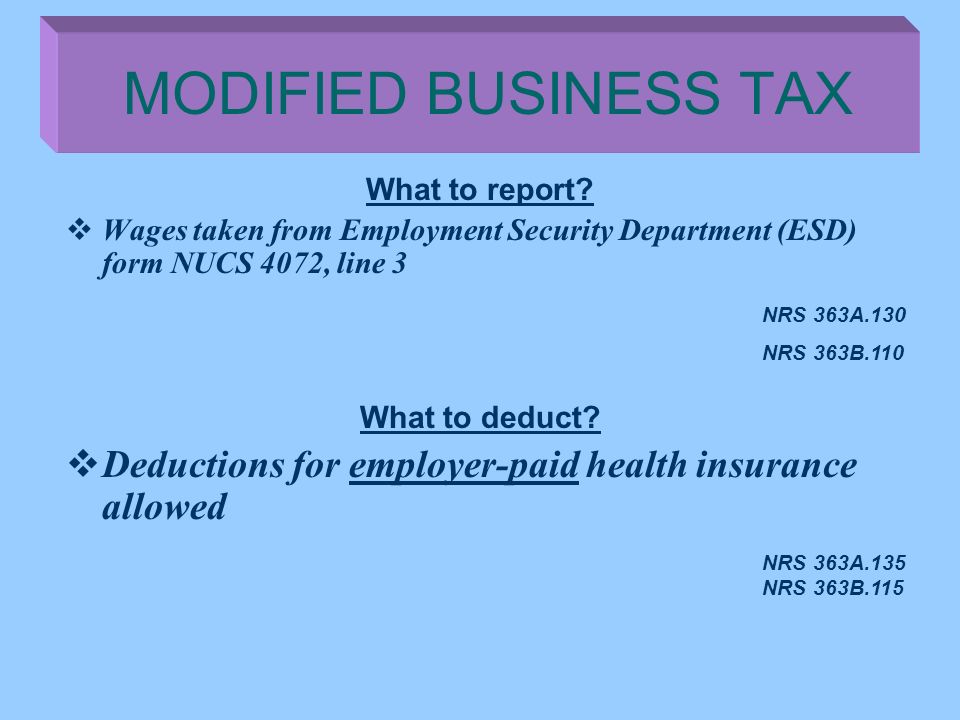

Similar to the personal income tax businesses must file a yearly tax return and are allowed deductions such as wages paid cost of goods sold and other qualifying business expenses. When Are the Forms and Tax Payments Due.

2 weeks when you file online.

. Nevada State Commerce Tax return is due between the end of the taxable year July 1st and the due date of the Commerce tax return - August 14th. Try to edit your document like signing highlighting and other tools in the top. Modified Business Tax Return-Mining 7-1-19 to Current This is the standard quarterly return for reporting the Modified Business Tax for businesses who are subject to the tax on the Net Proceeds of Minerals imposed pursuant to NRS 362.

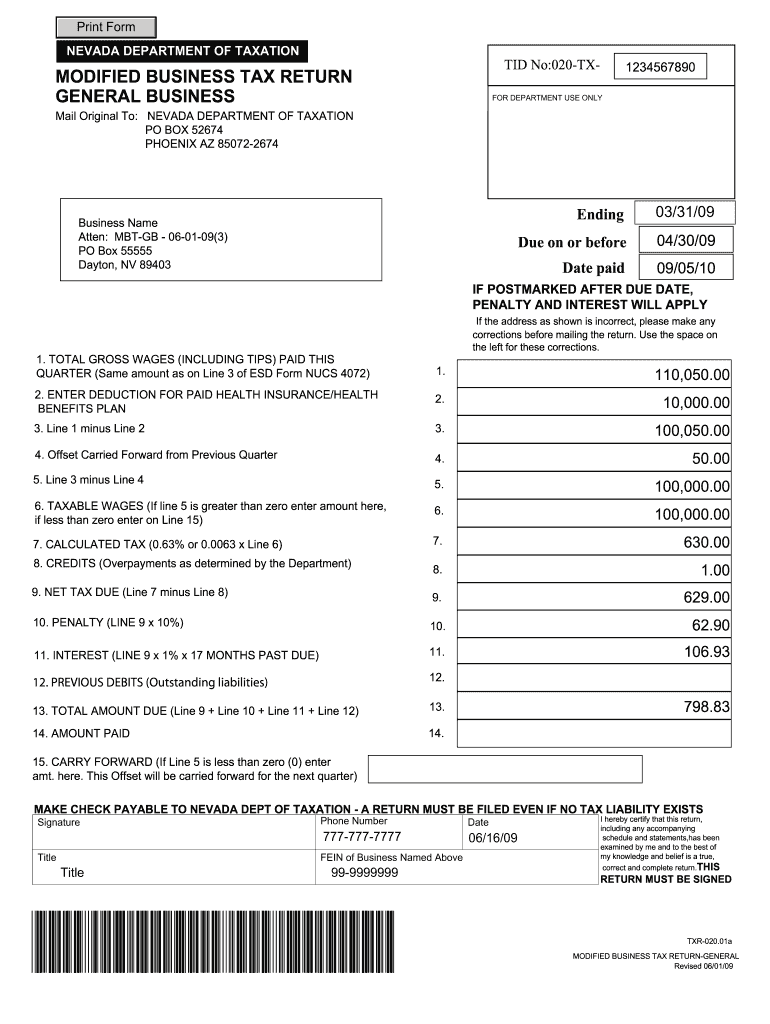

The direct or indirect ownership control or possession of 50 or more of the ownership interest. If the credit amount is higher than the MBT tax owed it may be carried forward up to the fourth quarter immediately. MODIFIED BUSINESS TAX RETURN Mail Original To.

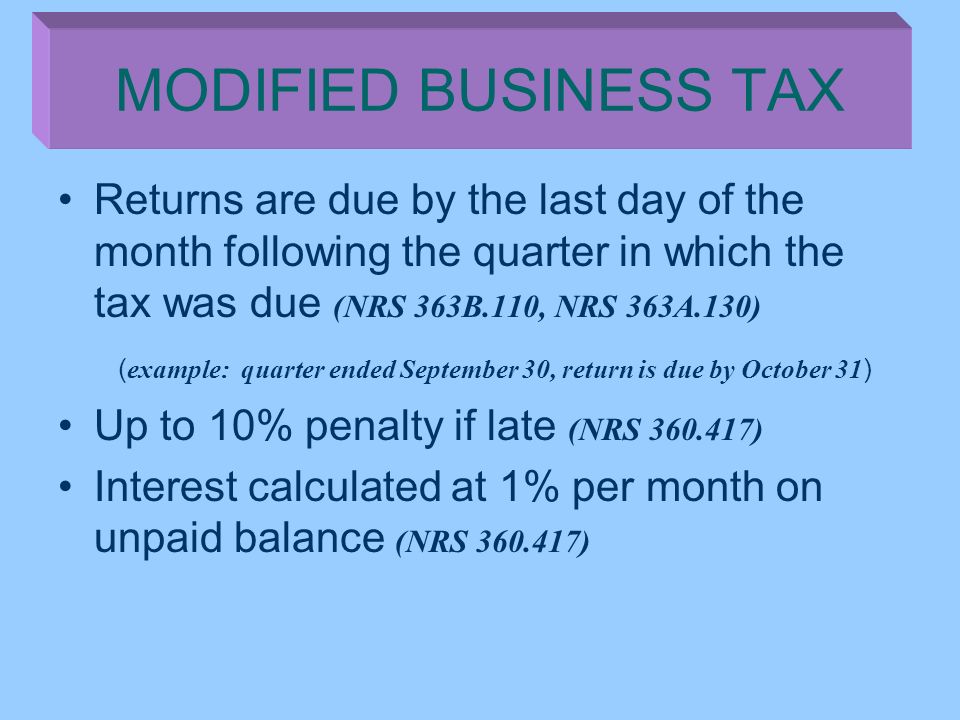

IF POSTMARKED AFTER DUE DATE PENALTY AND INTEREST WILL APPLY If the address as shown is incorrect please make any. For example the taxes were due January 31 but not paid until February 15. Quarter ended September 30 return is due by October 31 Late filing penalty up to 10 NRS 360417.

Tax for each calendar quarter is due on the last day of the quarter and is to be paid on or before the last day of the month following the quarter. Everything is done online and is much easier than submitting APP-0101 by mail. The default dates for submission are April 30 July 31 October 31 and January 31.

Modified business tax nevada due date. How to register for a Sales Tax Permit. NEVADA DEPARTMENT OF TAXATION PO BOX 52609 PHOENIX AZ 85072-2609 TID No020-TX PERIOD ENDING.

The result is the amount of penalty that should be entered. The number of days late is 15 so the penalty is 4. NEVADA DEPARTMENT OF TAXATION MODIFIED BUSINESS TAX RETURN Mail Original To.

Forms and payments have to be mailed or hand delivered to one of the four district offices of the Nevada Department of Taxation. Determine the number of days the payments is late and multiply the net tax owed by the appropriate rate based on the table below. For example if the taxes were due January 31 but not paid until February 15.

Clark County Tax Rate Increase - Effective January 1 2020. Q1 Jan - Mar April 30. 30 2019 to march 31 2021 for general businesses financial institutions and mining.

NEVADA DEPARTMENT OF TAXATION PO BOX 52674 PHOENIX AZ 85072-2674 FOR DEPARTMENT USE ONLY LICENSE NO. Wednesday March 30 2022. Enter your Nevada Tax Pre-Authorization Code.

As mentioned in our Nevada LLC filing forms lesson we recommend using the Common Business Registration via SilverFlume to obtain your Nevada LLCs Sales Tax Permit. Interest - If this return will not be postmarked and the taxes paid on or before the applicable due date enter 1 001 times line 11 for. Use the space on the left.

NEVADA DEPARTMENT OF TAXATION PO BOX 52674 PHOENIX AZ 85072-2674 FOR DEPARTMENT USE ONLY IF POSTMARKED AFTER DUE DATE PENALTY AND INTEREST WILL APPLY If the address as shown is incorrect please make any corrections before mailing the return. 1 and ends on May 1. The amount of penalty that should be entered.

Nevada State Corporate Income Tax 2021. Commerce Tax Credit - Enter 50 of the Commerce Tax paid in the prior tax year up to the amount of MBT tax owed. Modified Business Tax NRS 463370 Gaming License Fees NRS 680B Insurance Fees and Taxes.

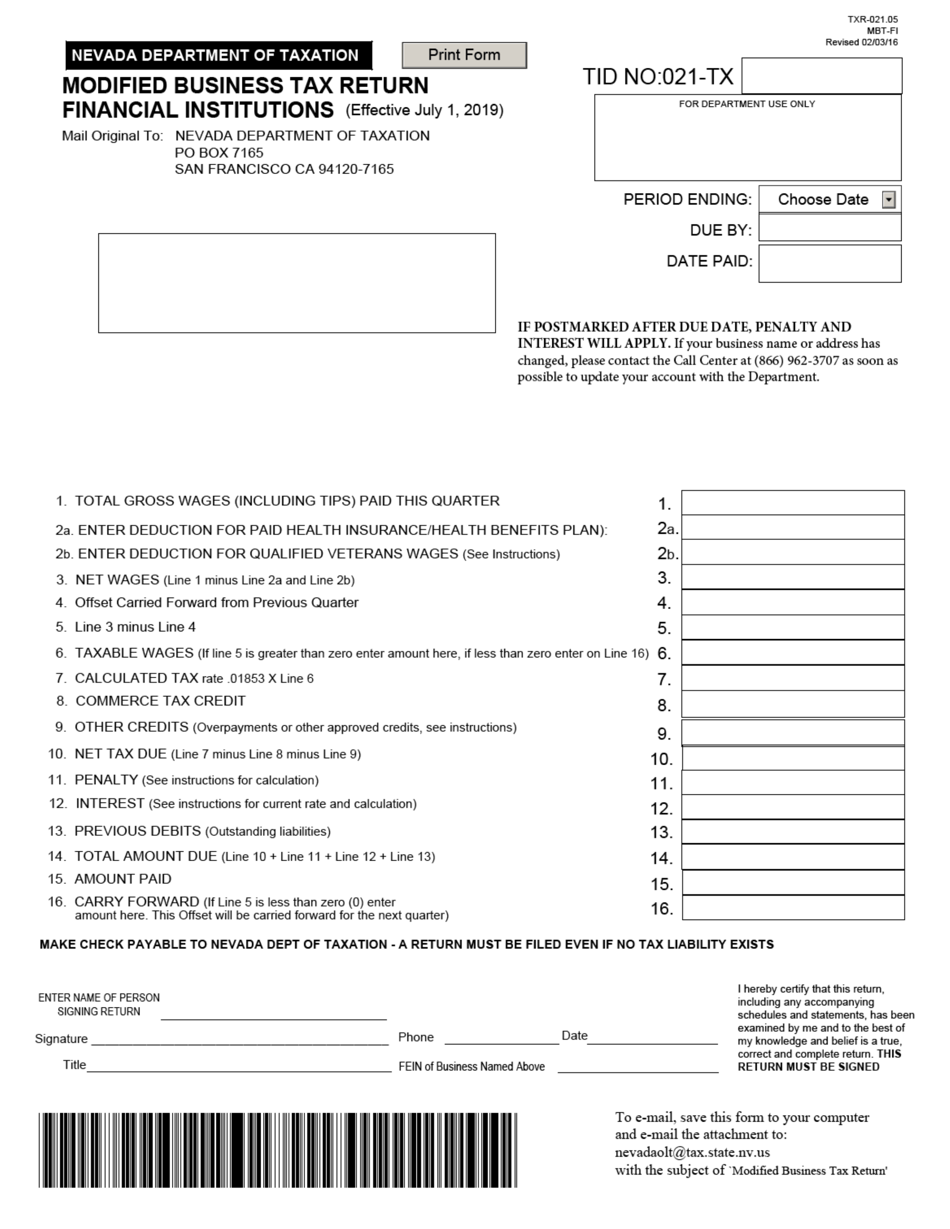

The 31st Special Session of the Nevada Legislature enacted Senate Bill 3 which provides for a one-time tax amnesty program for businesses or individuals doing business in Nevada who may have an existing tax liability. 021-TX-IF POSTMARKED AFTER DUE DATE PENALTY AND INTEREST WILL APPLY If the address as shown is incorrect please make any corrections. 1-866-457-6789Send an e-mail to taxfraudstatenmus Download the Fraud Information Report Form mail or fax it toNew Mexico Taxation and.

Do not enter an amount less than zero. Corporate tax refund from prior year by. The amnesty period will begin Feb.

How to Edit Your Modified Business Tax Return Nevada Online Easily and Quickly. This is the due date for corporate tax returns using Form 1120. Click Here for details.

Click the Get Form button on this page. The filing fee for a nonprofit corporation without stock is 5000. Nevada Department of Taxation PO Box 7165 San Francisco CA 94120-7165.

If the business ceased to exist before the end of the taxable year a short year return may be filed. SALT Report 3089 The Nevada Department of Taxation is advising taxpayers that the September 30 2013 modified business tax returns were printed with the old 62500. 12 rows Due Date Extended Due Date.

Effective July 1 2019 the tax rate changes to 1853 from 20. Ask the Advisor Workshops. Follow these steps to get your Modified Business Tax Return Nevada edited with accuracy and agility.

Q2 Apr - Jun July 31. Modified Business Tax Forms - Nevada For further guidance on Nevadas modified business tax check the State of Nevada Department. For additional questions about the Nevada Modified Business Tax see the following page from the State of Nevadas Department of Taxation.

Click here to schedule an appointment. Nevada Tax Notes or in written correspondence BUSINESS TAX -. When is the tax due.

The Department is now accepting credit card payments in Nevada Tax OLT. Sales Tax Permit fee. Businesses or individuals may pay its delinquent tax online using a credit card or debit.

You will be forwarded to our PDF editor. A tax return will still need to be filed by all employers even if the taxable wages are less than 50000 and tax due is 0. Call the 24-Hour New Mexico Tax Fraud Hot Line.

How to Edit Your Modified business tax return nevada Online Easily and Quickly. The default dates for submission are April 30 July 31 October 31 and January 31. Taxable wages x 2 02 the tax due.

Effective july 1 2019 the tax rate changes to 1853 from 20. If the due date falls on a weekend or holiday the return is due on the next business day. What is the Nevada Modified Business Tax.

The Nevada corporate income tax is the business equivalent of the Nevada personal income tax and is based on a bracketed tax system. For example the tax return and remittance for October 1 2006 through December 31 2006 was due on or before January 31 2007. Forms and payments must be mailed to the address below.

Modified Business Tax Refund. The due dates are April 30 July 31 October 31 and January 31. There are no changes to the Commerce Tax credit.

There are three ways to report tax fraud. The number of days late is 15 so the penalty is 4. Generally the due date is August 14.

NEVADA DEPARTMENT OF TAXATION MODIFIED BUSINESS TAX RETURN GENERAL BUSINESS Mail Original To. All forms and tax payments are due by the end of the month following the end of the four-month period.

How To File And Pay Sales Tax In Nevada Taxvalet

State Of Nevada Department Of Taxation Ppt Video Online Download

Get Nevada Modified Business Tax 2020 2022 Us Legal Forms

Tax Day Irs Pushes 2020 Tax Filing And Payment Due Date From April 15 2021 To May 17 2021 6abc Philadelphia

State Of Nevada Department Of Taxation Ppt Video Online Download

State Of Nevada Department Of Taxation Ppt Video Online Download

Form Txr 021 05 Mbt Fi Download Fillable Pdf Or Fill Online Modified Business Tax Return Financial Institutions Nevada Templateroller

How To Form An Llc In Nevada Llc Filing Nv Swyft Filings

What Is The Business Tax Rate In Nevada

State Of Nevada Department Of Taxation Ppt Video Online Download